Singapore, Recently – AiMoola, an innovative AI-native technology application, has officially launched, introducing its flagship product: a multimodal AI-driven collaborative expense management platform. Designed to transform personal and group finance management, AiMoola breaks away from traditional manual bookkeeping with natural, conversational interaction as its core.

While conventional bookkeeping apps still rely on complex forms and rigid categories, AiMoola ushers in the next generation of human-computer interaction. Users no longer need to manually create ledgers, enter data, or navigate reports. Instead, every action—whether recording, organizing, or querying—is executed through natural language, voice commands, or even by simply sending receipt images.

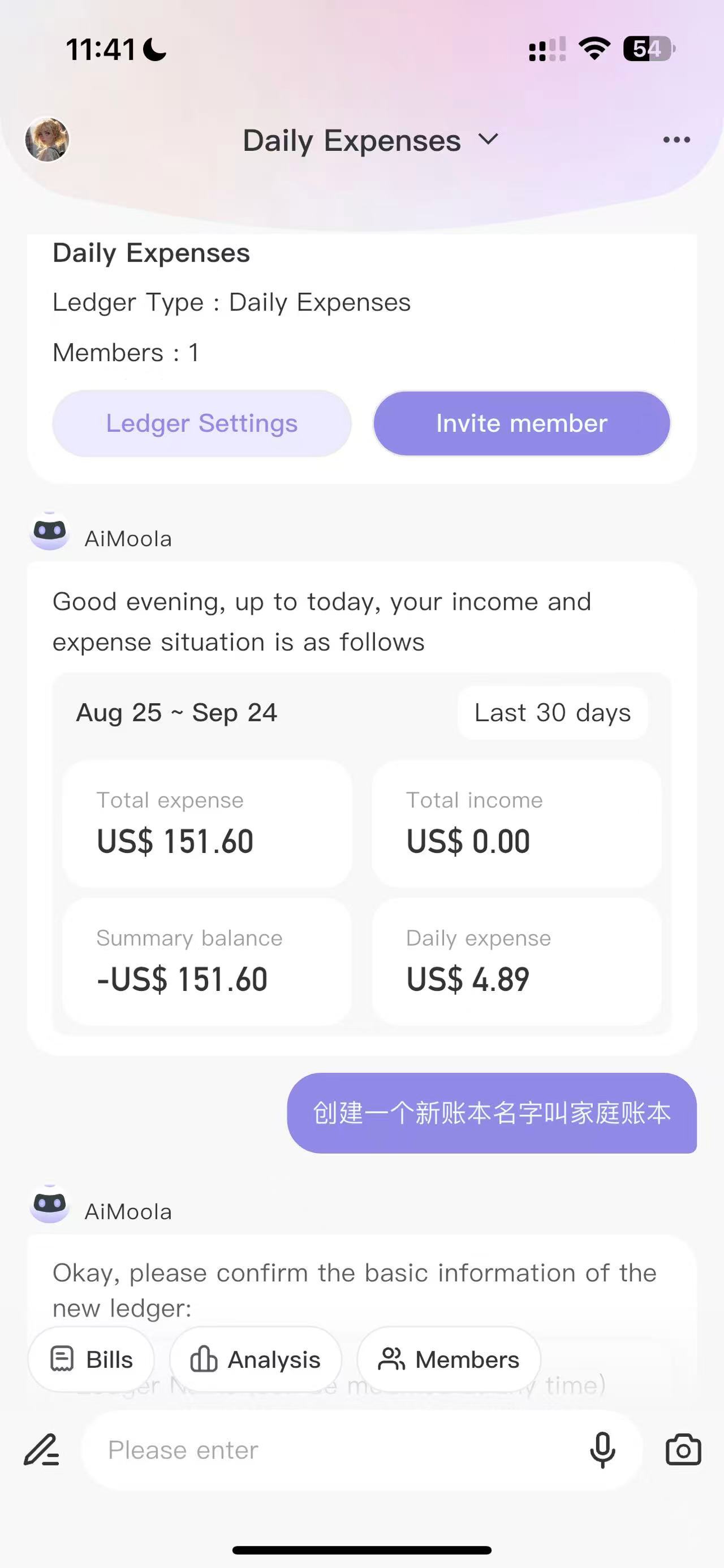

For example, a user can say: “Create a ledger called ‘Couple’s Life’ and invite Alice”—and the system instantly sets up the ledger and sends the invitation. Uploading a dinner receipt or saying “I spent $68 dining with Alice and Bob at 9 p.m. yesterday” triggers AiMoola’s AI to automatically identify the date, amount, currency, category, participants, and time, and log it seamlessly. To retrieve information, users can simply ask: “Show Alice’s expenses from last week” and receive instant results. AiMoola turns expense tracking from a tedious task into a natural, frictionless daily interaction.

Unlike traditional apps that tack on AI assistants, AiMoola is built from the ground up as a truly AI-native application. Its architecture is entirely powered by large language models (LLM) and computer vision (CV), making AI not a feature, but the very engine of the product.

“Most products in the market just add a chatbot on top of old software. That’s essentially an AI plug-in,” said Qing Huang, Founder of AiMoola. “With AiMoola, the entire data entry, processing, and analysis workflow is driven by AI. AI isn’t just part of the product—it is the product. This represents a fundamental shift from a ‘tool mindset’ to an ‘intelligent agent mindset.’”

This deep integration delivers three key advantages:

1. Radical convenience – multi-step operations reduced to a single conversation.

2. Contextual intelligence – semantic understanding of financial scenarios, enabling accurate cross-language categorization.

3. Proactive insights – the system can automatically generate financial reports or reminders based on historical data.

AiMoola’s ambition extends far beyond expense tracking. It is positioned as a benchmark for how AI agents can take root in real-world, high-frequency scenarios. By focusing on collaborative finance—a universal and recurring need—AiMoola demonstrates how multimodal AI can interpret user intent and autonomously handle complex workflows.

“Our chosen path is both essential and the perfect showcase for AI’s potential,” Huang added. “In the future, AiMoola will expand into financial planning, budgeting, and beyond. Our goal is to evolve into a personal financial AI agent that takes care of all your financial chores.”

The launch of AiMoola signals more than a new product release—it marks a paradigm shift in how humans interact with technology in one of life’s most fundamental areas: managing money.

AiMoola is developed by a Singapore-based technology company specializing in AI-native applications. Its flagship product is a multimodal AI-powered collaborative bookkeeping platform that leverages natural language processing and computer vision to simplify complex financial tasks. AiMoola’s mission is to make intelligent living accessible to everyone by transforming the way we interact with everyday finance.